The language is vague and given it is a new addition to the instructions, there is uncertainty of what additional information reporting is now required as compared to prior tax years. For failure to pay the tax on time, a penalty at the rate of 0.5 (0.

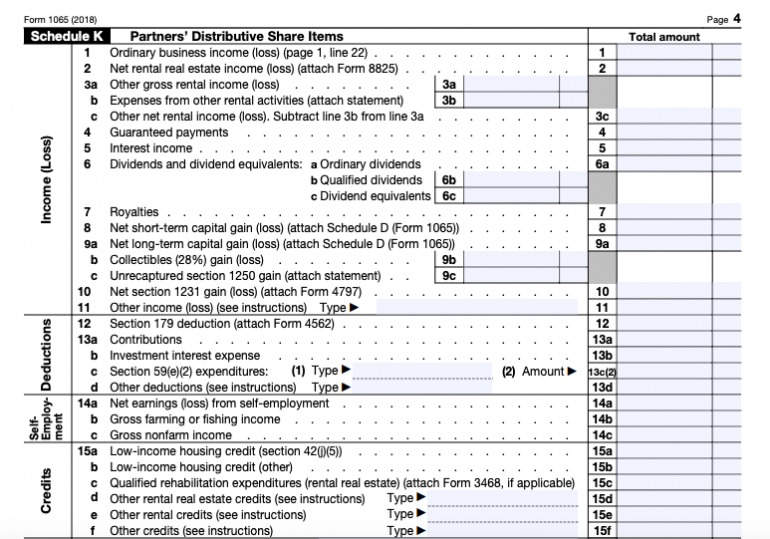

(b) Penalty on the balance due For failure to file the return on time, a penalty at the rate of 5 (0.0500) per month not to exceed 25 (0.2500) shall be assessed. This case driven course will deal with both. annum from the due date for filing the return to the actual date of payment. With the increasing complexity and ever-changing nature of tax laws and issues, today’s accountant needs a partnership/LLC course focusing on the hottest tax topics and most frequently encountered issues. The course includes dozens of “practice tips for new reviewers” and is updated for impacts of newly enacted legislation. prepare their tax returns, including information needed to prepare state and local tax returns on page 53 of the Form 1065 draft instructions. Partnership & LLC (Form 1065) Tax Return Review & Case Study. Its emphasis is not planning rather, it is to develop a strategy to properly review a return effectively and thoroughly. Yet how does one start? The purpose of this course is to give both new and seasoned reviewers additional and advanced procedures via a multitude of checklists to more thoroughly review S corporation and partnership tax returns. Most review techniques developed by professionals are self-taught and fine-tuned via experience.

0 kommentar(er)

0 kommentar(er)